-40%

antique Stock Certificate 1968 Anaconda mining company arco marcus daly s2

$ 5.28

- Description

- Size Guide

Description

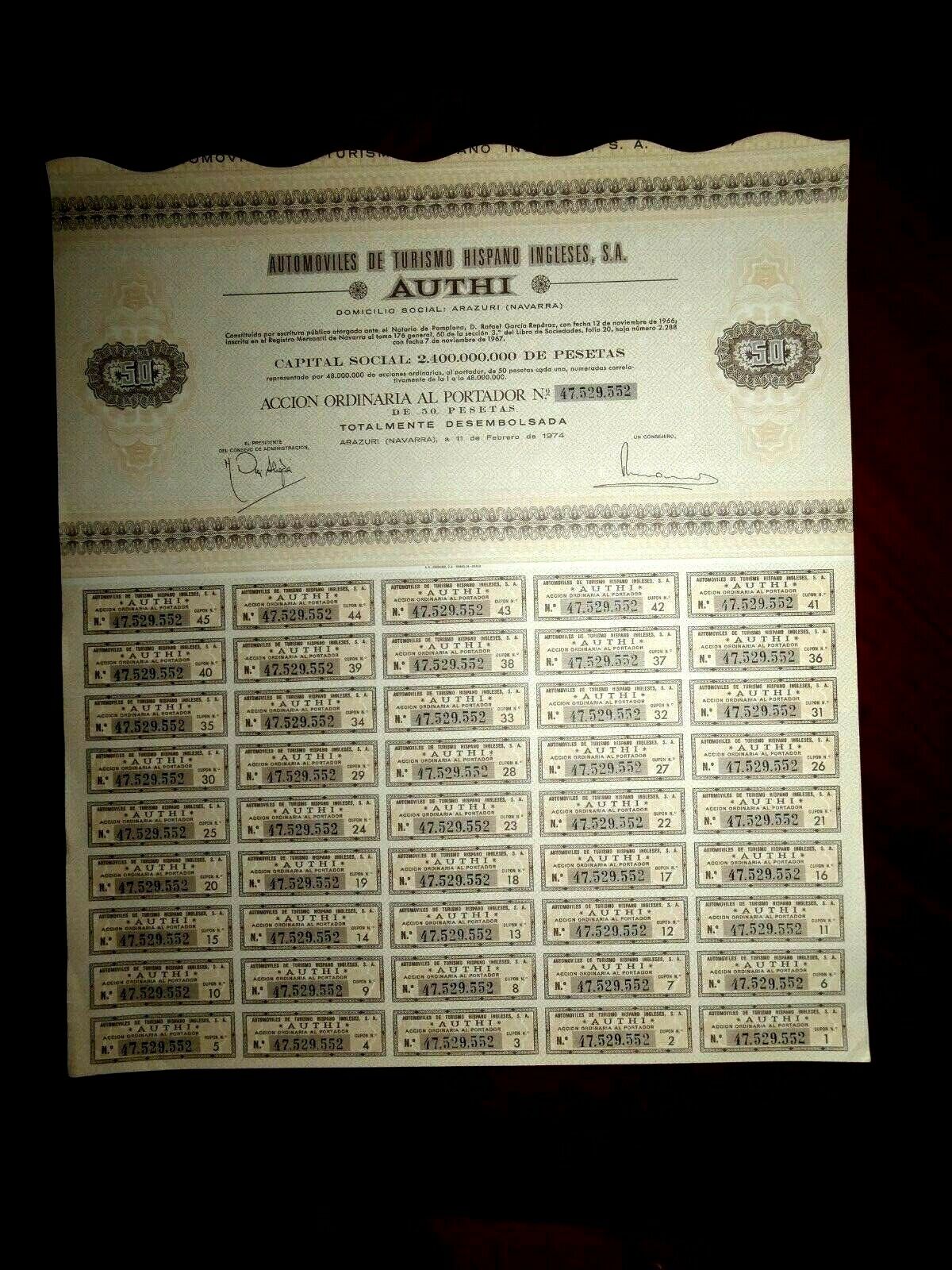

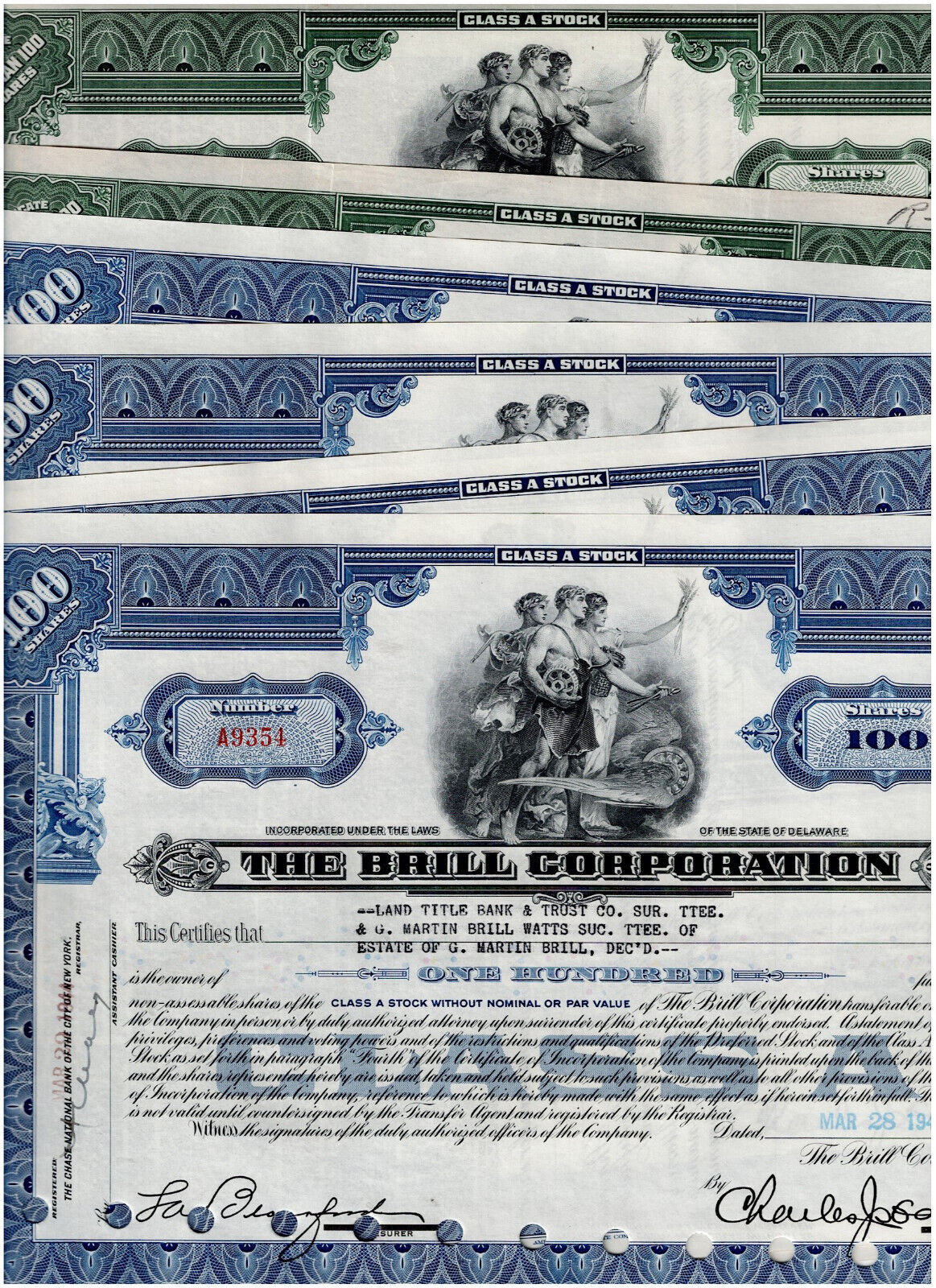

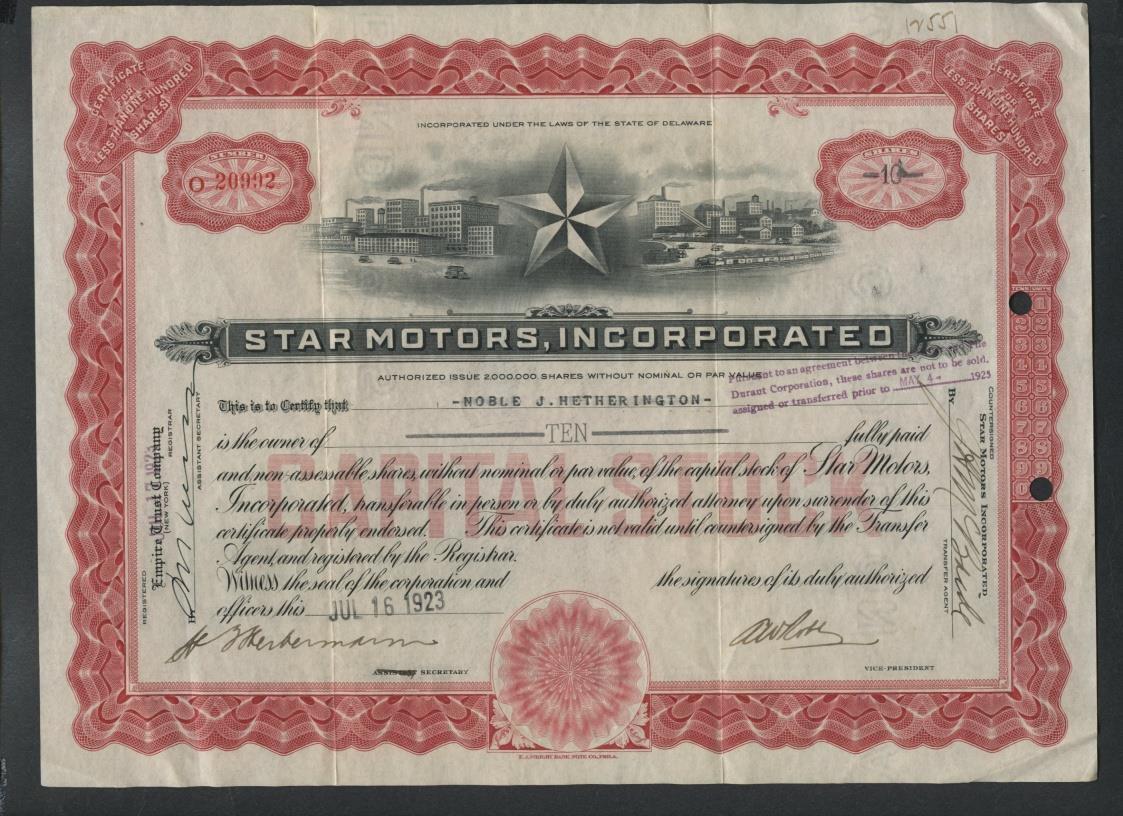

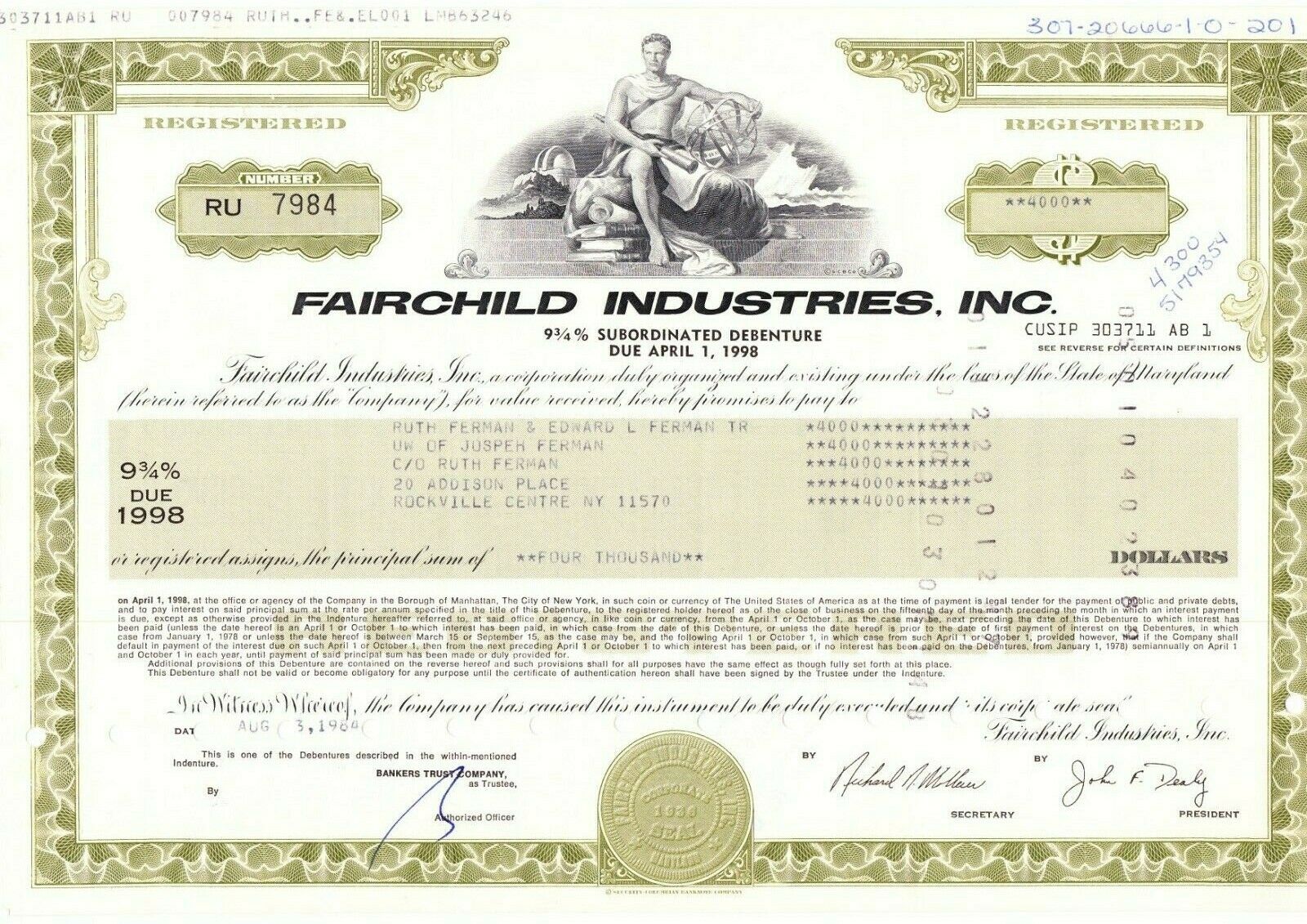

this item is a cancelled vintage stock certificate.great for framing or collecting

The Anaconda Copper Mining Company, part of the Amalgamated Copper Company from 1899 to 1915, was an American mining company. It was one of the largest trusts of the early 20th century and one of the largest mining companies in the world for much of the 20th century.

Founded in 1881 when

Marcus Daly

bought a silver mine, the company expanded rapidly based on the discovery of huge copper deposits. Daly built a smelter in

Anaconda

to process copper mined in

Butte

. Daly sold his assets in 1899 to

H H Rogers

and

William Rockefeller

.

By 1910, Amalgamated had expanded its operations and bought the assets of two other Montana copper companies. In 1922, Anaconda bought mining operations in Mexico and Chile; the latter was the largest mine in the world and yielded two-thirds of the company's profits. The company added aluminum reduction to its portfolio in 1955. In the 1950s, the company switched over from underground to

open-pit mining

.

In 1960 its operations still had 37,000 employees in North America and Chile. It was purchased by the Atlantic Richfield Company (

ARCO

) on January 12, 1977. Anaconda halted production in 1980, and mining ceased completely in 1982 when the deep pumps keeping the mine drained were shut off, allowing the

Berkeley Pit

to fill. What remains is a massive

Superfund

site, with

CERCLA liability

for

British Petroleum

, who bought out ARCO.

Rothschilds

Edit

In 1889 the

Rothschilds

tried to gain control of the world copper market. In 1892 the French Rothschilds began negotiations to buy the Anaconda mine. In mid-October 1895 the Rothschilds, French and British, bought one quarter of the stock in Anaconda for .5 million. By the late 1890s the Rothschilds probably had control over the sale of about forty percent of the world's copper production.

[4]

Rockefellers

Edit

The Rothschilds' role in Anaconda was brief. In 1899, Daly teamed up with two directors of

Standard Oil

to create the giant

Amalgamated Copper Mining Company

, one of the largest trusts of the early 20th century. The leading roles in the takeover were played by

Henry Huttleston Rogers

(

John D. Rockefeller

's friend and a key man in his Standard Oil businesses) and

William Rockefeller

(John's brother). They were aided by company promoter

Thomas W. Lawson

. Although Rogers and William Rockefeller were Standard Oil directors, the company of Standard Oil did not have a stake in this business, nor did its founder and head,

John D. Rockefeller

, who disliked such stock promotions.

[5]

By 1899 Amalgamated Copper acquired majority stock in the Anaconda Copper Company, and the Rothschilds appear to have had no further role in the company. By his death in 1900, Marcus Daly had just become president of the holding company valued at million.

Lawson later had a falling out with Rogers and Rockefeller, and wrote of the experience in a book Frenzied Finance (1905). Colored by Lawson's bitterness, the book offered insight into aspects of high finance.